Who needs the IRS form 3911?

This form is sent to taxpayers who asked for tax refunds and didn’t receive them (for various reasons). If this situation occurs, the IRS will send you this form to complete.

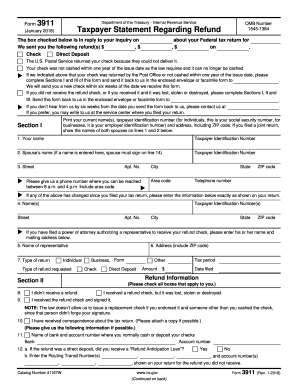

What is the IRS form 3911?

This form is called the Taxpayer Statement Regarding Refund. The statement is used by the IRS to check information about the refund of taxes to a certain taxpayer. After you contact the IRS, they will fill out the top section of the form and send it back to you. The IRS needs to know the reason why you haven’t received the refund: it will be

Is the IRS form 3911 accompanied by other forms?

You don’t have to attach other forms to the IRS form 3911.

Does the IRS form 3911 have a validity period?

The sooner you contact the IRS, the sooner they start the process concerning your tax refund, so it is best not to delay.

What information should be provided in the IRS form 3911?

The top of the form is completed by the IRS. They will indicate the date of your refund, the tax year, the number of refund check and the reason why you didn’t receive the refund: the postal service returned your check because it couldn’t be delivered, your check was not cashed within one year of the issue date, you never received the refund check, or the refund check was stolen.

The taxpayer should provide the following information:

- Name and Taxpayer ID

- Name and Tax ID of the spouse

- Address, phone number

- Any changes in the personal information

- Name of representative and his address

- Type of the return (individual, business, other)

- Type of refund requested

- Information about the refund (the taxpayer has to check and fill out all the required boxes.)

What do I do with the form after its completion?

The completed form must be sent back to the IRS.