IRS 3911 2022-2025 free printable template

Show details

Return to us in the envelope provided or fax the form to. Note You must complete a separate Form 3911 for each refund for which you are requesting information. Note If you are in possession of a check which was not cashed within one year of the issue date as the law requires it can no longer be cashed contact the service for instructions on how to return your check. For information on how to complete or where to send this form visit...

pdfFiller is not affiliated with IRS

Instructions and Help about the IRS Form 3911 2025

How to edit the IRS form 3911 online

How to fill out the 3911 form for a stimulus check

Video instructions and help with filling out and completing the federal tax form 3911

Instructions and Help about the IRS Form 3911 2025

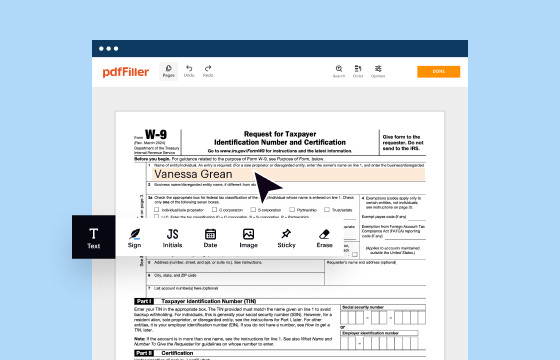

Accuracy and compliance with official IRS requirements are crucial in preparing tax documentation. Here, you will find practical recommendations on how to fill out and modify your form 3911 IRS PDF template online before filing it to your local taxing authority.

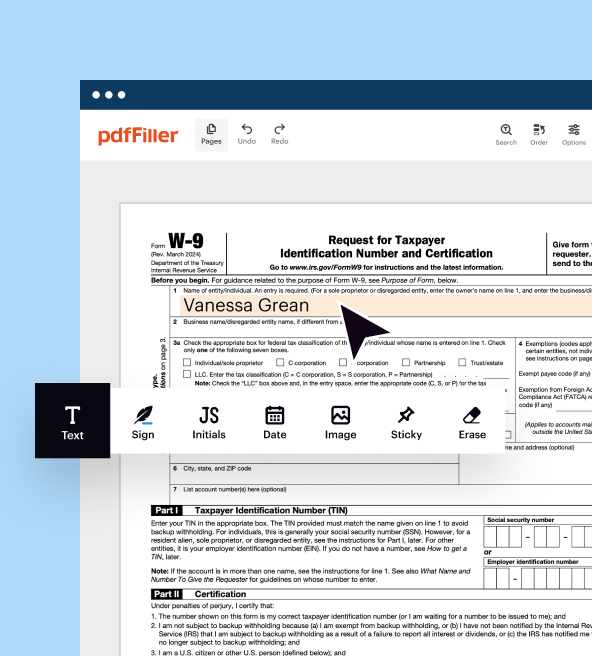

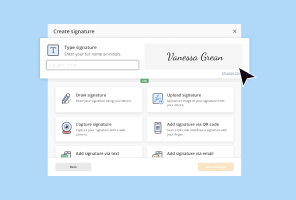

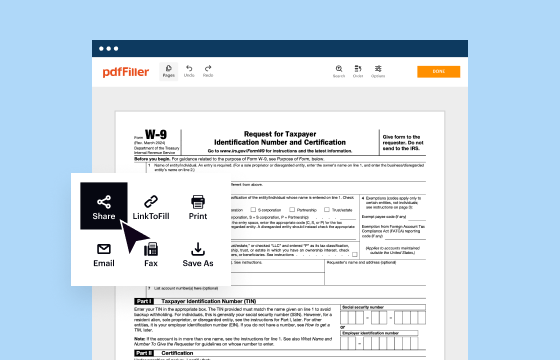

How to edit the IRS form 3911 online

Even when preparing form 3911 to print and send to the Internal Revenue Service by mail or fax, pdfFiller remains one of the most efficient solutions. It enables you to easily fill out the blank, make the necessary edits, and send the completed copy within minutes.

Follow the guide below to edit your taxpayer statement online:

01

Click Get Form to open the fillable form 3911 template in the editor.

02

Check the official instructions provided in the document before taking any action.

03

Fill out fillable fields with requested details using Text and Check tools.

04

Use the upper toolbar to make major edits, like erasing or highlighting the elements.

05

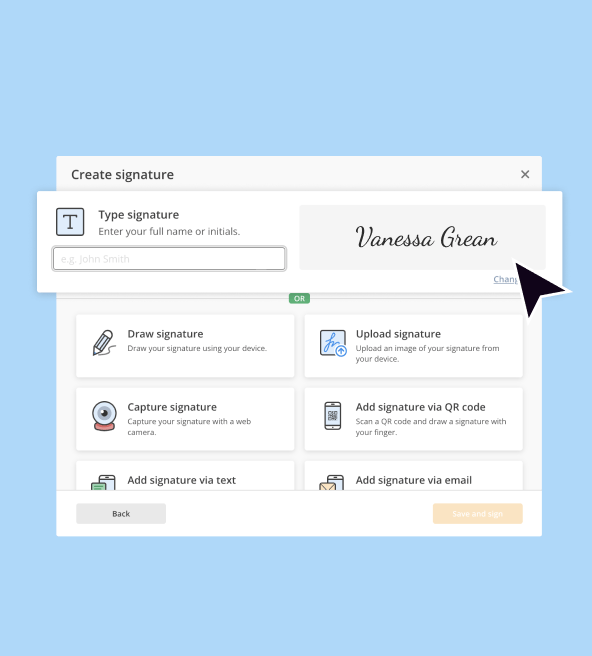

Finalize document completion with Date and Sign buttons and click Done to end editing.

06

Create an account with pdfFiller and start a 30-day free trial with the platform.

07

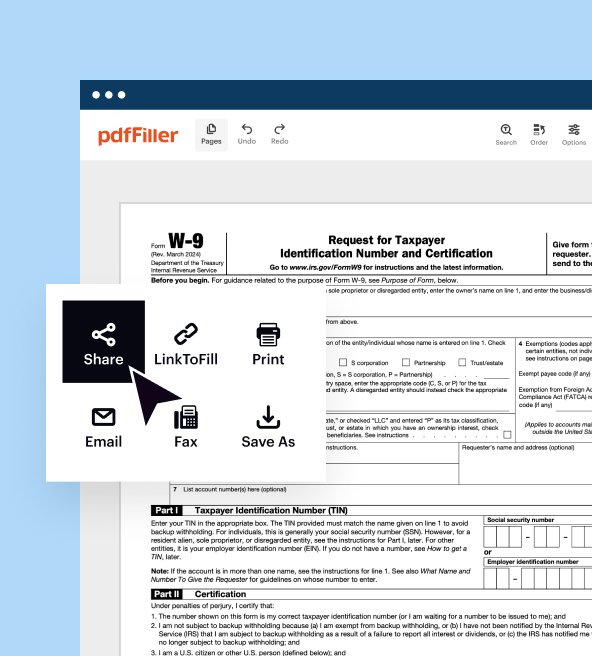

To save your completed IRS form 3911, download it or export it to the cloud.

08

Print your copy or use the Fax or Mail by USPS option to file it to the IRS.

pdfFiller is your trustworthy assistant for managing professional documents and preparing tax statements. Try it now!

How to fill out the 3911 form for a stimulus check

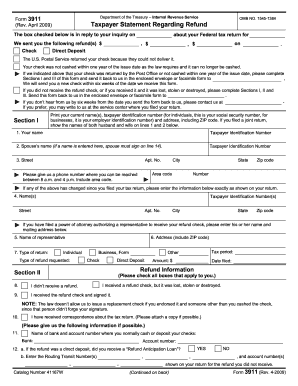

The IRS form 3911 (Taxpayer Statement Regarding Refund) is a one-page document that requests basic details about the taxpayer and a type of missed return. However, as with any other tax document, accuracy and attention are required when filling out the document fields.

Here’s a walkthrough for completing the federal tax form 3911:

01

Look through the document and determine which fields you should fill out. If some fields don't apply to you, don't leave them empty; instead, mark them as N/A.

02

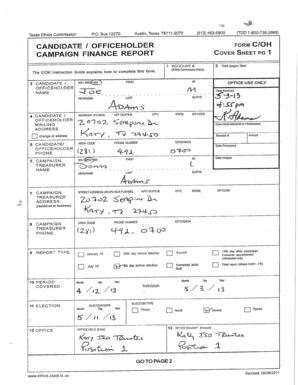

If you received the form from the Internal Revenue Service regarding an earlier inquiry, the upper area will be already completed with the date of your inquiry, the tax year for which you want to trace your refund, and the fax number where to send form 3911.

03

Complete Section I with taxpayer information. Provide your name and your spouse’s name (if expecting a refund for a joint return), taxpayer identification number (SSN or ITIN for individuals or EIN for businesses), full address with the ZIP code, and contact phone number, including the area code.

04

If you authorized someone to receive your refund check, enter your representative's name and mailing address, including the ZIP code.

05

Indicate the type of return, tax period, and filing date. Provide detailed information about the requested refund, including its type and amount, along with the bank name, account type, account number, and Bank RTN.

06

Complete Section II with the refund information. Check the appropriate box for the refund status (whether you didn’t receive it, received a refund check that was lost, stolen, or destroyed, or received and signed the check).

07

Verify all details for accuracy, then move on to Section III to finalize your document. Put the date and your valid signature. Remember that your spouse, as mentioned in Section I, must also sign IRS form 3911.

Video instructions and help with filling out and completing the federal tax form 3911

Show more

Show less

Updates to Form 3911 2025

Mailing Addresses by State

Foreign Countries, U.S. Territories, APO/FPO Addresses, and Dual-Status Aliens

For Business Entities

Self-Help Tools for Taxpayers

Updates to Form 3911 2025

Form 3911 (Taxpayer Statement Regarding Refund) has been updated with new mailing addresses, fax numbers, and tools available for taxpayers to submit refund inquiries and trace lost checks. Below are the current addresses and fax numbers by state

Mailing Addresses by State

Maine, Maryland, Massachusetts, New Hampshire, Vermont

Andover Refund Inquiry Unit

310 Lowell St, Mail Stop 666

Andover, MA 01810

Fax: 855-253-3175

Andover Refund Inquiry Unit

310 Lowell St, Mail Stop 666

Andover, MA 01810

Fax: 855-253-3175

Georgia, Iowa, Kansas, Kentucky, Virginia

Atlanta Refund Inquiry Unit

4800 Buford Hwy, Mail Stop 112

Chamblee, GA 30341

Fax: 855-275-8620

Atlanta Refund Inquiry Unit

4800 Buford Hwy, Mail Stop 112

Chamblee, GA 30341

Fax: 855-275-8620

Florida, Louisiana, Mississippi, Oklahoma, Texas

Austin Refund Inquiry Unit

3651 S IH 35 STOP 6542

Austin, TX 78741-7855

Fax: 855-203-7538

New York

Brookhaven Refund Inquiry Unit

1040 Waverly Ave, Mail Stop 547

Holtsville, NY 11742

Fax: 855-297-7736

Brookhaven Refund Inquiry Unit

1040 Waverly Ave, Mail Stop 547

Holtsville, NY 11742

Fax: 855-297-7736

Alaska, Arizona, California, Colorado, Hawaii, Nevada, New Mexico, Oregon, Utah, Washington, Wisconsin, Wyoming

Fresno Refund Inquiry Unit

3211 S Northpointe Dr, Mail Stop B2007

Fresno, CA 93725

Fax: 855-332-3068

Fresno Refund Inquiry Unit

3211 S Northpointe Dr, Mail Stop B2007

Fresno, CA 93725

Fax: 855-332-3068

Arkansas, Connecticut, Delaware, Indiana, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, Ohio, West Virginia

Kansas City Refund Inquiry Unit

333 W Pershing Rd, Mail Stop 6800, N-2

Kansas City, MO 64108

Fax: 855-344-9993

Kansas City Refund Inquiry Unit

333 W Pershing Rd, Mail Stop 6800, N-2

Kansas City, MO 64108

Fax: 855-344-9993

Alabama, North Carolina, North Dakota, South Carolina, South Dakota, Tennessee

Memphis Refund Inquiry Unit

5333 Getwell Rd, Mail Stop 8422

Memphis, TN 38118

Fax: 855-580-4749

Memphis Refund Inquiry Unit

5333 Getwell Rd, Mail Stop 8422

Memphis, TN 38118

Fax: 855-580-4749

District of Columbia, Idaho, Illinois, Pennsylvania, Rhode Island

Philadelphia Refund Inquiry Unit

2970 Market St, DP 3-L08-151

Philadelphia, PA 19104

Fax: 855-404-9091

Philadelphia Refund Inquiry Unit

2970 Market St, DP 3-L08-151

Philadelphia, PA 19104

Fax: 855-404-9091

Cincinnati Refund Inquiry Unit

PO Box 145500, Mail Stop 536G

Cincinnati, OH 45250

Fax: 855-307-3124

PO Box 145500, Mail Stop 536G

Cincinnati, OH 45250

Fax: 855-307-3124

Ogden Refund Inquiry Unit

1973 N Rulon White Blvd, Mail Stop 6733

Ogden, UT 84404

Fax: 855-578-2550

1973 N Rulon White Blvd, Mail Stop 6733

Ogden, UT 84404

Fax: 855-578-2550

Foreign Countries, U.S. Territories, APO/FPO Addresses, and Dual-Status Aliens

Austin Refund Inquiry Unit

3651 S Interregional Hwy 35, Mail Stop 6542 AUSC

Austin, TX 78741

Fax: 855-203-7538

3651 S Interregional Hwy 35, Mail Stop 6542 AUSC

Austin, TX 78741

Fax: 855-203-7538

For Business Entities

West of the Mississippi: send authorizations to Ogden

East of the Mississippi: send authorizations to Cincinnati, with exceptions for Arkansas and Louisiana, which also go to Cincinnati, and Wisconsin, which goes to Ogden.

East of the Mississippi: send authorizations to Cincinnati, with exceptions for Arkansas and Louisiana, which also go to Cincinnati, and Wisconsin, which goes to Ogden.

Self-Help Tools for Taxpayers

Taxpayers can also utilize self-help options to track the status of their refunds:

Where’s My Refund? — The tool displays the status of the current year’s tax return plus the two prior years.

IRS2Go App — This app provides a convenient way to check refund status, make payments, and find free tax help in English and Spanish.

Tax Records and Transcripts — This service allows taxpayers to access personal and business tax records.

Access Business Tax Transcripts — This tool will help you retrieve your business tax records transcripts.

Replace a Lost Refund Check — This valuable option provides instructions for requesting a replacement for a lost refund check.

These resources and the updated contact details ensure taxpayers can efficiently address any issues related to lost or unreceived refund checks.

Show more

Show less

All You Need to Know About The IRS Form 3911

What is the IRS form 3911?

Who needs to file the federal tax form 3911?

What information should be provided in the IRS form 3911?

When should I complete IRS form 3911?

Where should I file the federal tax form 3911?

All You Need to Know About The IRS Form 3911

Preparing tax paperwork requires a deep understanding of each document to ensure accurate and timely reporting. Below, you will find essential information about federal tax form 3911, including its purpose and unique features, to consider before submitting it to the Internal Revenue Service.

What is the IRS form 3911?

Form 3911 (Taxpayer Statement Regarding Refund) is an official document used by the Internal Revenue Service to help taxpayers track down missing or misplaced federal tax refund checks. It allows taxpayers to notify the IRS of a refund check issued but not received or lost, initiating the refund trace process.

Who needs to file the federal tax form 3911?

The 3911 statement is for all U.S. taxpayers, both individuals and businesses, who expected their tax refund but didn't receive it or lost the check. It's particularly crucial for those who suspect their refund may have been lost in the mail, exposed to identity theft, or affected by other issues preventing successful delivery.

What information should be provided in the IRS form 3911?

The fillable form 3911 is a one-page document that consists of the following components:

Section I collects taxpayer information, including their name, address, phone number, SSN/EIN, and the name and address of an authorized representative if any. It also requests types of return and refund to trace, tax period, and the taxpayer’s bank account details.

Section II provides options for taxpayers to choose the reason they're inquiring (e.g., they didn’t receive a refund, they received the check and signed it, or they lost, stolen, or destroyed the check).

Section III requires the date of document submission and the taxpayer's signature to affirm the accuracy of the information provided under penalties of perjury. There’s also a field for the taxpayer's spouse’s signature in case of a joint return.

The second page includes the Privacy Act and Paperwork Reduction Act Notice. Specific instructions on how to file form 3911 or complete it correctly are not included. For detailed guidelines, please refer to the IRS website.

When should I complete IRS form 3911?

There is no specific deadline for submitting the federal tax form 3911. Taxpayers should only file it after confirming with the IRS that their refund has been issued but not received within the expected timeframe. Typically, this applies if a refund hasn't been received four weeks after the mailing date or six weeks if results are unavailable online. For direct deposits, ensure at least five days have passed since your tax service office issued it. Before filing, check the refund status via the IRS Refunds service. The Internal Revenue Service recommends waiting at least four weeks for in-state mailed checks, six weeks for out-of-state, and nine weeks for forwarding or foreign addresses to accommodate possible delays. Filing prematurely may result in confusion or duplicate processes.

Where should I file the federal tax form 3911?

You can submit your taxpayer statement regarding a refund only by mail or fax, as e-filing is not an option. The appropriate mailing address and fax number for submitting your statement vary depending on your state of residence. These details are available on the IRS website. Please be aware that the listed fax numbers are exclusively for 3911 statements, and no other documents should be sent there.

Usually, you'll send your completed statement to the IRS service center, where you filed your original tax return. The IRS normally provides an envelope with the correct return address where to send form 3911. If you have this self-addressed envelope, use it to send your statement to the specified address.

Show more

Show less

FAQ

Can you fill out the IRS form 3911 online?

Unfortunately, the e-filing option for this document is not an option. You can only send your 3911 statement via email or fax. However, you can still complete and sign it electronically with tools like pdfFiller. To do so, upload the IRS form 3911 printable template to the editor, carefully fill out the blanks, add a valid electronic signature, print the completed copy, or use the editor’s native Fax or Mail by USPS file-sending options.

How do I fill out form 3911 for the missing refund check?

You can either download the 3911 template and complete a printed copy manually or use pdfFiller to prepare it electronically on any device. Regardless of your chosen method, be attentive when filling out your taxpayer information, banking details, and the types of refund and return requested.

Who do I call to get the form 3911?

If you suspect your refund check has been stolen or destroyed, promptly contact the Internal Revenue Service. Use the automated system at 800-829-1954 or speak with an agent at 800-829-1040 (you can check the complete list of resources for taxpayer assistance and telephone hours of operation here). Next, download and fill out your statement.

How long does it take the IRS to respond to the form 3911?

The IRS's time to trace a missing tax refund check can vary based on case complexity, inquiry volume, and document errors. Generally, a response is expected within six weeks. However, it may take longer, for example, during peak periods, especially around the tax season. After the tax office reviews your case and confirms your refund check was lost, stolen, or destroyed, they will begin the process of canceling the original check and issuing a replacement.

What is the penalty for the late filing form 3911?

Since there’s no deadline for reporting your lost, stolen, or destroyed refund check, there’s also no penalty for the form’s late submission. However, delaying the document submission may prolong the process of resolving your refund issue, potentially leading to a longer wait to receive your missing refund. Therefore, filing the statement as soon as you realize there is an issue with your tax refund is advisable.

Where do I find the IRS stimulus check?

The Internal Revenue Service publishes all tax-related forms on its website, where you can download the latest document version. It’s also easy to find the appropriate template with pdfFiller, a comprehensive online solution for professional document management. The platform features an extensive library of over 25M fillable document templates, so you can locate the IRS form 3911 printable template in seconds. Open it in the editor and start customizing it using advanced editing features.

How do I fill out 3911 on an Android device?

pdfFiller is the perfect solution for preparing your tax documentation, as it works on any device. Create an account, start a 30-day free trial, and set up the pdfFiller app for Android from Google Play. This will enable you to quickly fill out, edit, eSign your statement, print it from the editor for further mailing by USPS, and even fax it to the appropriate tax office right from the app.

How can I check the refund status?

To check your federal tax refund status, visit the IRS website and use the "Where's My Refund?" option. You'll need your Social Security Number (or Individual Taxpayer Identification Number), filing status, and the exact refund amount from your tax return. You can also check your refund status by phone but only after the Where's My Refund recommends doing so. Be ready to provide the same information required for the online tool: your Social Security Number, filing status, and refund amount.

Our user reviews speak for themselves

Explore our user feedback on pdfFiller and start a free trial to explore its benefits firsthand.

PDF Filler is easy to use and practical.

once purchased, this was very easy to use, friendly, and efficient.

Fill out IRS form 3911